Pcp Car Leasing: The Ultimate Guide to Driving Brand New for Less

Are you dreaming of driving a brand-new car without the hefty upfront cost or long-term commitment of ownership? If so, you've probably come across the term Pcp Car Leasing. It sounds complicated, but trust us, it's one of the most popular ways to finance a vehicle in the UK today. It offers flexibility that traditional loans simply can't match.

This guide will break down everything you need to know about Personal Contract Purchase (PCP). We'll cover how it works, what the benefits and drawbacks are, and most importantly, help you decide if Pcp Car Leasing is the perfect choice for your motoring needs. Let's dive right in!

What Exactly is Pcp Car Leasing?

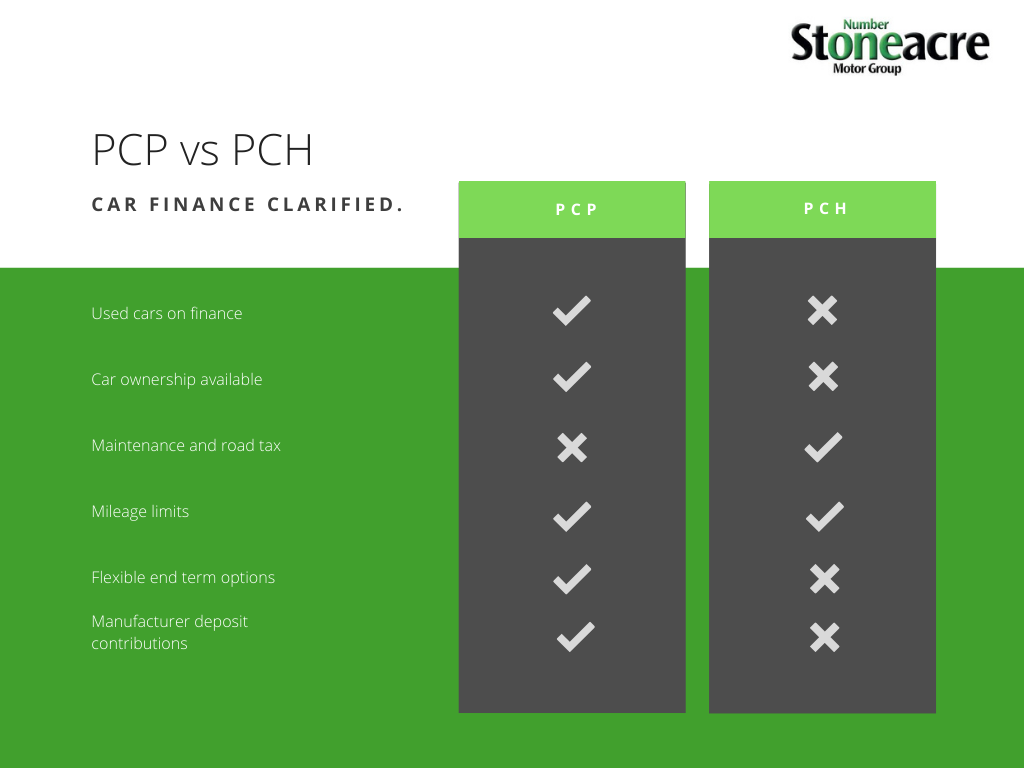

Technically speaking, PCP (Personal Contract Purchase) isn't a true "lease." A lease means you rent the vehicle and never have the option to buy it. PCP, on the other hand, is a specific type of financing agreement. It's essentially a loan where you defer a large chunk of the total cost until the very end of the contract.

You are only paying for the depreciation of the vehicle over the term of the agreement, plus interest. This is why your monthly payments are significantly lower than a standard Hire Purchase (HP) agreement. Pcp Car Leasing allows drivers to access higher-specification or more expensive cars for a manageable monthly outlay.

The contract usually lasts between 24 and 48 months. Throughout this period, you make fixed monthly payments. When the term ends, you have three options regarding the vehicle, which is the key difference between PCP and standard leasing.

Deconstructing the Pcp Car Leasing Process

Understanding the steps involved is crucial before signing on the dotted line. The process is quite straightforward once you break it down.

- Choose Your Vehicle and Term: You first select the new (or nearly new) car you want and the length of your contract (e.g., 3 years).

- Estimate Mileage: You provide an estimated annual mileage (e.g., 10,000 miles). This estimate is vital as it directly impacts the car's guaranteed future value (GFV).

- Determine the Deposit: You pay an initial deposit, which is flexible and negotiable. The higher the deposit, the lower your subsequent monthly payments will be.

- Calculate Monthly Payments: The finance provider calculates the GFV and determines your monthly payments based on the difference between the vehicle price and the GFV, plus interest and fees.

- Drive the Car: You drive the car for the duration of the contract, paying fixed monthly instalments.

- End of Contract Decision: After the term ends, you decide whether to buy, return, or part-exchange the vehicle.

Crucially, the monthly payments in Pcp Car Leasing cover the anticipated depreciation, not the total cost of the car. This makes budgeting far easier for many individuals and families.

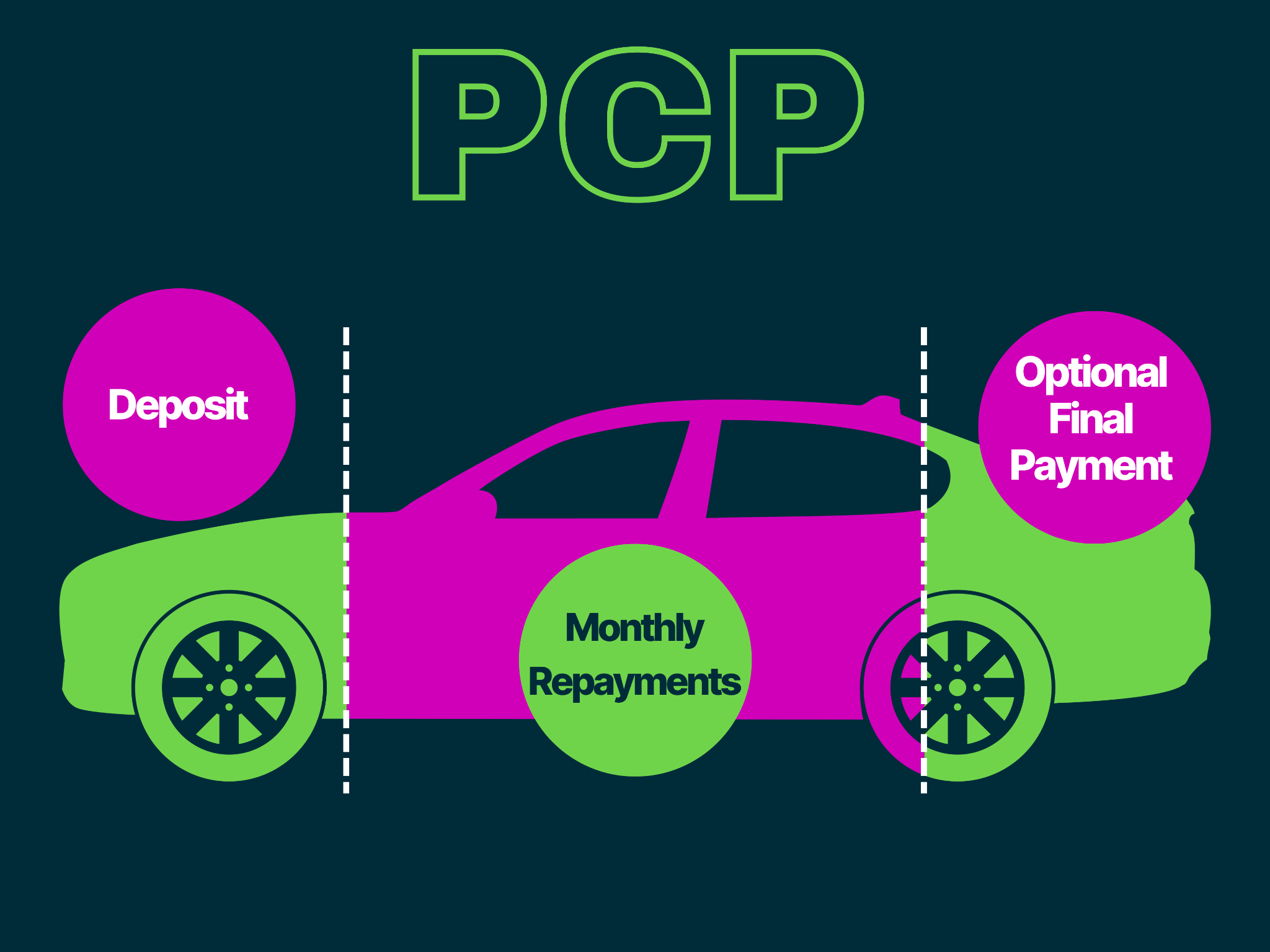

Understanding the Three Key Pillars of PCP

To fully grasp how affordable Pcp Car Leasing can be, you need to understand the three main financial elements that construct the deal:

- The Initial Deposit: This is the amount you pay upfront. While zero-deposit deals exist, paying a deposit will reduce the overall amount of credit needed, thus lowering interest charges and monthly payments.

- The Monthly Payments: These payments cover the difference between the initial cost of the car and its estimated value at the end of the contract (the GFV), plus the interest applied to that difference.

- The Guaranteed Future Value (GFV): This is the crucial, pre-determined value of the car at the end of the term, based on your contract length and mileage allowance. This amount is guaranteed by the finance provider, shielding you from unexpected drops in used car values.

The calculation is essentially: (Car Price - GFV) + Interest = Total Monthly Payments. Because the GFV covers a significant portion of the cost, your payments remain low.

The Optional Final Payment (GFV) Explained

This is where the flexibility of Pcp Car Leasing really shines. Once your contract ends, you have control over what happens next. You aren't obligated to do anything other than follow the terms you agreed to.

Here are your three options when the contract matures:

1. Return the Car: You simply hand the keys back to the finance company. Assuming you haven't exceeded the agreed mileage or damaged the car beyond "fair wear and tear," you walk away debt-free. This is often the preferred choice for those who love frequently upgrading their vehicle.

2. Buy the Car: If you love the vehicle and want to keep it, you can pay the optional final payment (the GFV). Once this payment is made, the car is legally yours. You can pay this lump sum outright or potentially refinance it.

3. Part-Exchange (Trade In): You can use any equity built up in the car toward a deposit on a new PCP agreement. If the car is valued higher than the GFV (a common scenario if used car values are strong), that difference is your equity or 'positive net worth,' which acts as your deposit for the next car.

Is Pcp Car Leasing Right for You? (Benefits and Drawbacks)

While Pcp Car Leasing is incredibly popular, it isn't a one-size-fits-all solution. Weighing the pros and cons based on your driving habits and financial goals is crucial.

Benefits of PCP Car Leasing:

- Lower Monthly Payments: Because you are only financing the depreciation, your monthly costs are significantly lower than a traditional loan.

- Drive New Cars Regularly: The short contract terms (2–4 years) allow you to upgrade frequently, meaning you're always driving a modern vehicle with the latest safety and technology features.

- Flexibility: The three end-of-contract options give you freedom, whether you want to own the car, trade it in, or just walk away.

- Protection Against Depreciation: The GFV guarantees a minimum value, protecting you if the market value of your specific model unexpectedly crashes.

Drawbacks of PCP Car Leasing:

- Mileage Limits: If you exceed the contracted annual mileage, you will face hefty excess mileage charges when you return the vehicle.

- Not True Ownership: You are essentially renting the car until the final payment is made. If you choose to return the car, you own nothing at the end of the term.

- Mandatory Insurance and Maintenance: Many Pcp Car Leasing contracts require fully comprehensive insurance and adherence to dealer-approved servicing schedules, which can add to the total running costs.

- Interest Rates: The interest is calculated on the full price of the car, even though you aren't paying that full amount monthly, meaning the overall cost of borrowing can sometimes be higher than a traditional loan, especially if you decide to buy the car at the end.

Navigating Mileage Limits and Fair Wear and Tear

These two clauses are often where drivers get caught out when returning a vehicle. When you enter a Pcp Car Leasing agreement, you must be realistic about your driving habits.

If you think you might drive 15,000 miles a year, don't agree to a 10,000-mile contract just to save a few pounds monthly. The excess mileage penalty (often 10p to 20p per mile) can quickly negate any initial savings.

Fair wear and tear is another key term. This covers minor damage expected from normal use, like small stone chips or slight scuffing on wheel trims. However, major damage—such as dents, broken glass, or significantly stained upholstery—will result in repair charges being levied when you return the car.

Always review the Fair Wear and Tear guidelines provided by the finance company when you take out the contract. Maintaining the car in excellent condition throughout the Pcp Car Leasing term is essential to avoid unexpected costs.

Final Thoughts Before Diving into Pcp Car Leasing

Before committing to Pcp Car Leasing, make sure you compare quotes from multiple providers, including dealerships and independent finance brokers. The Annual Percentage Rate (APR) can vary significantly and heavily influence the total amount of interest you pay.

Ensure you clearly understand the total cost of credit. While the monthly payments are appealingly low, if you intend to buy the car outright at the end, the total amount paid (deposit + monthly payments + final GFV payment) might be higher than a simple Hire Purchase or bank loan.

PCP works best for those who treat their car as a necessity that needs to be replaced often, rather than a long-term asset to be kept for many years. It is a fantastic tool for managing cash flow while driving a high-quality, reliable vehicle.

***

Conclusion: The Verdict on Pcp Car Leasing

Pcp Car Leasing offers unparalleled flexibility and affordability for accessing new vehicles. By only paying for the depreciation of the car, drivers can enjoy lower monthly instalments, making expensive cars suddenly accessible. However, this convenience comes with strict rules regarding mileage and vehicle condition.

If you keep your mileage predictable and take meticulous care of your car, PCP offers a brilliant pathway to consistent upgrades. But if you frequently drive long distances or are prone to bumping the bodywork, you might be better suited to traditional ownership. Ultimately, Pcp Car Leasing is about financing freedom and ensuring you have options when the contract term comes to an end.

Frequently Asked Questions About Pcp Car Leasing

- Can I end my Pcp Car Leasing agreement early?

- Yes, but you will usually need to settle the finance, which means paying the remaining monthly payments plus the Guaranteed Future Value (GFV). Under the 'Voluntary Termination' clause (usually after 50% of the loan is paid), you may be able to hand the car back without further obligation, but you lose any equity.

- What happens if the car is worth less than the GFV?

- This is one of the main advantages of PCP. If the market value is lower than the Guaranteed Future Value, you are protected. You can simply hand the car back, and the finance company absorbs the loss. You will not owe the difference.

- Is insurance included in Pcp Car Leasing payments?

- No, usually insurance is separate and mandatory. You must take out fully comprehensive insurance throughout the duration of the agreement. Some deals might bundle maintenance or insurance, but this is less common.

- Is PCP better than traditional Hire Purchase (HP)?

- It depends on your goal. HP means higher monthly payments, but you own the car outright once the final payment is made. PCP means lower payments and flexibility, but you must pay the GFV if you wish to own it. If you want ownership, HP is simpler; if you want flexibility and low payments, Pcp Car Leasing is better.

Pcp Car Leasing

Pcp Car Leasing Wallpapers

Collection of pcp car leasing wallpapers for your desktop and mobile devices.

Amazing Pcp Car Leasing Artwork in HD

Discover an amazing pcp car leasing background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Pcp Car Leasing Moment for Your Screen

This gorgeous pcp car leasing photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Pcp Car Leasing Photo for Your Screen

Explore this high-quality pcp car leasing image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Pcp Car Leasing Abstract Digital Art

Transform your screen with this vivid pcp car leasing artwork, a true masterpiece of digital design.

Lush Pcp Car Leasing Design for Your Screen

This gorgeous pcp car leasing photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Pcp Car Leasing Background Digital Art

A captivating pcp car leasing scene that brings tranquility and beauty to any device.

Crisp Pcp Car Leasing View Digital Art

This gorgeous pcp car leasing photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Pcp Car Leasing Photo for Mobile

Immerse yourself in the stunning details of this beautiful pcp car leasing wallpaper, designed for a captivating visual experience.

High-Quality Pcp Car Leasing Photo for Your Screen

Transform your screen with this vivid pcp car leasing artwork, a true masterpiece of digital design.

Vibrant Pcp Car Leasing View for Desktop

Transform your screen with this vivid pcp car leasing artwork, a true masterpiece of digital design.

Serene Pcp Car Leasing Image for Your Screen

Experience the crisp clarity of this stunning pcp car leasing image, available in high resolution for all your screens.

Exquisite Pcp Car Leasing Scene for Desktop

A captivating pcp car leasing scene that brings tranquility and beauty to any device.

Beautiful Pcp Car Leasing Image Illustration

Discover an amazing pcp car leasing background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Pcp Car Leasing Moment Concept

Immerse yourself in the stunning details of this beautiful pcp car leasing wallpaper, designed for a captivating visual experience.

Spectacular Pcp Car Leasing Wallpaper for Mobile

Find inspiration with this unique pcp car leasing illustration, crafted to provide a fresh look for your background.

Breathtaking Pcp Car Leasing Photo Nature

Discover an amazing pcp car leasing background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Pcp Car Leasing Photo Nature

Transform your screen with this vivid pcp car leasing artwork, a true masterpiece of digital design.

Beautiful Pcp Car Leasing Scene Concept

Explore this high-quality pcp car leasing image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Pcp Car Leasing Artwork for Your Screen

Find inspiration with this unique pcp car leasing illustration, crafted to provide a fresh look for your background.

Lush Pcp Car Leasing Capture in 4K

A captivating pcp car leasing scene that brings tranquility and beauty to any device.

Download these pcp car leasing wallpapers for free and use them on your desktop or mobile devices.