Decoding Honda Financing Rates: Your Ultimate Guide

So, you've decided on a new Honda—maybe a sleek Civic or a reliable CR-V. That's the fun part! Now comes the slightly less exciting, yet crucial, step: figuring out the financing. Understanding current Honda financing rates can feel like navigating a maze, but don't worry, it's entirely manageable once you know the core factors at play.

The truth is, there isn't one universal rate for everyone. Your specific Annual Percentage Rate (APR) will depend on a host of personal financial variables, market conditions, and the specific model you choose. Our goal here is to demystify these rates, ensuring you walk into the dealership armed with the knowledge to secure the best deal possible.

Ready to break down exactly what goes into calculating those crucial numbers? Let's dive in!

Understanding What Affects Your APR

When lenders, including Honda Financial Services (HFS), evaluate your loan application, they are assessing risk. The lower the perceived risk, the lower the interest rate they are willing to offer you. It's that simple. Several key factors directly influence where you land on the spectrum of available Honda financing rates.

The Power of Your Credit Score

This is arguably the single most important factor. Your credit score is a numerical snapshot of your financial reliability. A high score tells the lender that you have a history of paying debts on time, making you a low-risk borrower.

Before you even step foot in the dealership, knowing your FICO score range is essential. This allows you to realistically benchmark the Honda financing rates you should expect to receive. Generally, rates are tiered based on these ranges:

- Excellent Credit (740+): You qualify for the lowest promotional rates, including 0% or near-zero APR offers if available.

- Good Credit (680–739): You can still access very competitive rates, though they might be slightly higher than the top tier.

- Fair Credit (620–679): Rates start to increase here, reflecting a moderate level of risk for the lender.

- Poor Credit (Below 620): Rates will be significantly higher, as lenders use the added interest to offset the higher risk of default.

Loan Term and Down Payment

Beyond your credit history, the structure of the loan itself plays a massive role in the final APR. Shorter loan terms—think 36 or 48 months—typically carry lower interest rates than longer terms like 72 or 84 months.

Why? Because the lender is exposed to risk for a shorter period. While a longer term means smaller monthly payments, it costs you much more in total interest over the life of the loan. Always consider the total cost, not just the monthly payment.

Furthermore, a substantial down payment reduces the principal amount borrowed. This demonstrates your commitment and reduces the lender's risk, often leading to a better interest rate offering.

Where to Find the Best Honda Financing Rates

Savvy car buyers never accept the first financing offer presented to them. To truly secure the best deal, you must compare offers from multiple sources. Shopping for financing is just as important as shopping for the car itself.

Dealership vs. Credit Union: Comparing Your Options

You essentially have two main avenues for securing a loan for your Honda: the dealership's finance office (which works through various banks, including HFS) and external financial institutions.

It's wise to get pre-approved through an outside source first. This way, you have a solid "baseline rate" to compare against anything the dealership offers. Here is a quick comparison:

- Dealership Financing (Honda Financial Services):

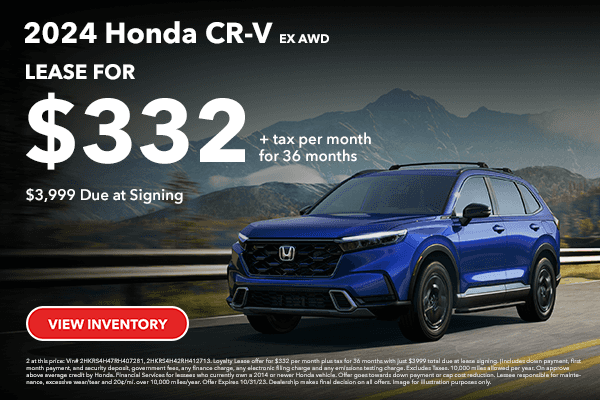

- Pros: Convenient, often the source of special promotional APR deals (e.g., 1.9% or 0% financing), and a quick, one-stop process.

- Cons: May not shop around to find you the absolute lowest rate unless you push them, sometimes rely on competitive external offers to negotiate.

- Banks and Credit Unions:

- Pros: Credit unions often boast the absolute lowest interest rates because they are non-profit organizations. Pre-approval gives you powerful negotiating leverage.

- Cons: Requires extra steps and paperwork outside of the dealership environment.

Tapping into Honda Financial Services (HFS) Special Offers

If you have excellent credit, keep a close eye on the manufacturer's special incentives. Honda Financial Services frequently runs programs offering ultra-low Honda financing rates, sometimes as low as 0% APR on specific new models, typically for shorter terms (e.g., 24 or 36 months).

These special offers are usually reserved for those with top-tier credit (740+ FICO score) and are highly time-sensitive, often changing month-to-month. If you qualify, these promotional rates will almost always beat any offer you find elsewhere.

Just remember that these deals are usually only available on specific models and may require you to forego other incentives, like cash rebates. Always calculate which option saves you the most money overall.

Quick Steps Before You Sign the Paperwork

Securing competitive Honda financing rates requires preparation. Following these steps will put you in the driver's seat during negotiations.

- Check Your Credit Report: Don't just check your score; review the full report for errors. Mistakes can unfairly raise your rate.

- Get Pre-Approved Externally: Apply to at least two credit unions or banks before visiting the dealership. This gives you a guaranteed maximum rate.

- Define Your Budget: Decide what total loan amount and monthly payment you are comfortable with, and stick to it, regardless of the dealer's sales tactics.

- Focus on the APR, Not Just the Payment: Dealers might try to stretch the loan term (e.g., from 60 to 72 months) to lower the monthly payment, but this drastically increases the total interest you pay. Always prioritize getting the lowest APR possible.

- Be Ready to Say No: If the dealer's rate is higher than your pre-approval rate, politely decline their financing and use your external loan. They may counter with a lower rate to keep the business internal.

The key takeaway is that financing is competitive. Lenders want your business, and using competition to your advantage is the best way to save thousands over the life of your Honda loan.

Conclusion: Mastering Your Honda Financing Rates

Securing a fantastic rate on your new Honda is completely achievable with a little bit of legwork. Remember that your credit score, the loan term, and the down payment you provide are the biggest variables that lenders consider. By understanding these factors and comparing offers from both external lenders and Honda Financial Services, you move from being a passive borrower to an informed negotiator.

Don't settle for the first number thrown your way. Research the best current Honda financing rates for your credit tier, secure your pre-approval, and drive away knowing you got the best possible deal on your new ride. Happy driving!

Frequently Asked Questions (FAQ) About Honda Financing Rates

- What is the difference between APR and interest rate?

- The interest rate is simply the cost of borrowing the principal amount. The APR (Annual Percentage Rate) includes the interest rate PLUS any additional fees or costs associated with obtaining the loan, giving you a truer picture of the total annual cost of borrowing.

- Can I get 0% APR financing on a used Honda?

- It is extremely rare to find 0% APR on used vehicles, including Certified Pre-Owned (CPO) Hondas. Manufacturer-backed special financing, like 0% offers, is almost exclusively reserved for brand-new models to boost sales. Used car rates are typically higher due to the increased depreciation and risk associated with older vehicles.

- How often do Honda financing rates change?

- Promotional Honda financing rates and incentives often change monthly, usually at the beginning of the new calendar month. However, standard base rates that banks offer fluctuate based on changes to the federal funds rate set by the Federal Reserve and overall economic conditions.

- Does the model (e.g., Civic vs. Pilot) affect the financing rate?

- Yes, sometimes. While your creditworthiness is the main factor, manufacturers often offer better promotional rates (subsidized rates) on specific models they are trying to move, or on models from the previous year. Always check the incentives tied to the exact model and trim level you are considering.

Honda Financing Rates

Honda Financing Rates Wallpapers

Collection of honda financing rates wallpapers for your desktop and mobile devices.

Stunning Honda Financing Rates Design in 4K

A captivating honda financing rates scene that brings tranquility and beauty to any device.

Spectacular Honda Financing Rates Background Collection

Find inspiration with this unique honda financing rates illustration, crafted to provide a fresh look for your background.

Spectacular Honda Financing Rates Landscape for Mobile

Find inspiration with this unique honda financing rates illustration, crafted to provide a fresh look for your background.

Breathtaking Honda Financing Rates Artwork Nature

Discover an amazing honda financing rates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Honda Financing Rates Design Digital Art

Discover an amazing honda financing rates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Honda Financing Rates Artwork for Mobile

Find inspiration with this unique honda financing rates illustration, crafted to provide a fresh look for your background.

Dynamic Honda Financing Rates Background Nature

A captivating honda financing rates scene that brings tranquility and beauty to any device.

Vivid Honda Financing Rates View Collection

Discover an amazing honda financing rates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Honda Financing Rates Landscape Concept

Discover an amazing honda financing rates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Honda Financing Rates Artwork Collection

A captivating honda financing rates scene that brings tranquility and beauty to any device.

Detailed Honda Financing Rates Artwork Nature

Transform your screen with this vivid honda financing rates artwork, a true masterpiece of digital design.

Vibrant Honda Financing Rates Capture in 4K

Experience the crisp clarity of this stunning honda financing rates image, available in high resolution for all your screens.

Dynamic Honda Financing Rates Artwork Nature

A captivating honda financing rates scene that brings tranquility and beauty to any device.

Vibrant Honda Financing Rates View for Desktop

Explore this high-quality honda financing rates image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Honda Financing Rates Moment Photography

Transform your screen with this vivid honda financing rates artwork, a true masterpiece of digital design.

High-Quality Honda Financing Rates Image Digital Art

Experience the crisp clarity of this stunning honda financing rates image, available in high resolution for all your screens.

Stunning Honda Financing Rates Picture for Your Screen

Find inspiration with this unique honda financing rates illustration, crafted to provide a fresh look for your background.

Crisp Honda Financing Rates Picture Illustration

This gorgeous honda financing rates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Honda Financing Rates Wallpaper for Your Screen

A captivating honda financing rates scene that brings tranquility and beauty to any device.

Serene Honda Financing Rates Artwork Photography

Experience the crisp clarity of this stunning honda financing rates image, available in high resolution for all your screens.

Download these honda financing rates wallpapers for free and use them on your desktop or mobile devices.