Average Monthly Auto Insurance: Your Guide to Understanding Costs

Ever wonder what the "average monthly auto insurance" cost really looks like, or why your premium might seem higher or lower than your friend's? You're not alone! Car insurance can feel like a mystery, but understanding the factors that go into your average monthly auto insurance bill is simpler than you think. Let's break it down together, helping you make sense of those numbers.

Navigating the world of car insurance can be confusing, especially when you're just trying to get a clear picture of what you might pay. This guide is here to demystify those costs, providing you with clear, actionable insights into how your average monthly auto insurance premium is calculated and what you can do about it.

What Influences Your Average Monthly Auto Insurance Cost?

There isn't a single, one-size-fits-all answer for the average monthly auto insurance premium, and that's because so many variables come into play. Think of it like a personalized puzzle where each piece adds to the final picture of your rate. Insurers look at a multitude of details to assess your risk, which then dictates what you'll pay each month.

From who you are to what you drive, and even where you live, these elements combine to determine your unique average monthly auto insurance cost. Understanding these components is your first step towards potentially finding better rates.

Personal Factors That Drive Your Premium

Your personal profile plays a huge role in setting your average monthly auto insurance rate. Insurers use this information to predict how likely you are to file a claim. Let's look at the key personal details that matter:

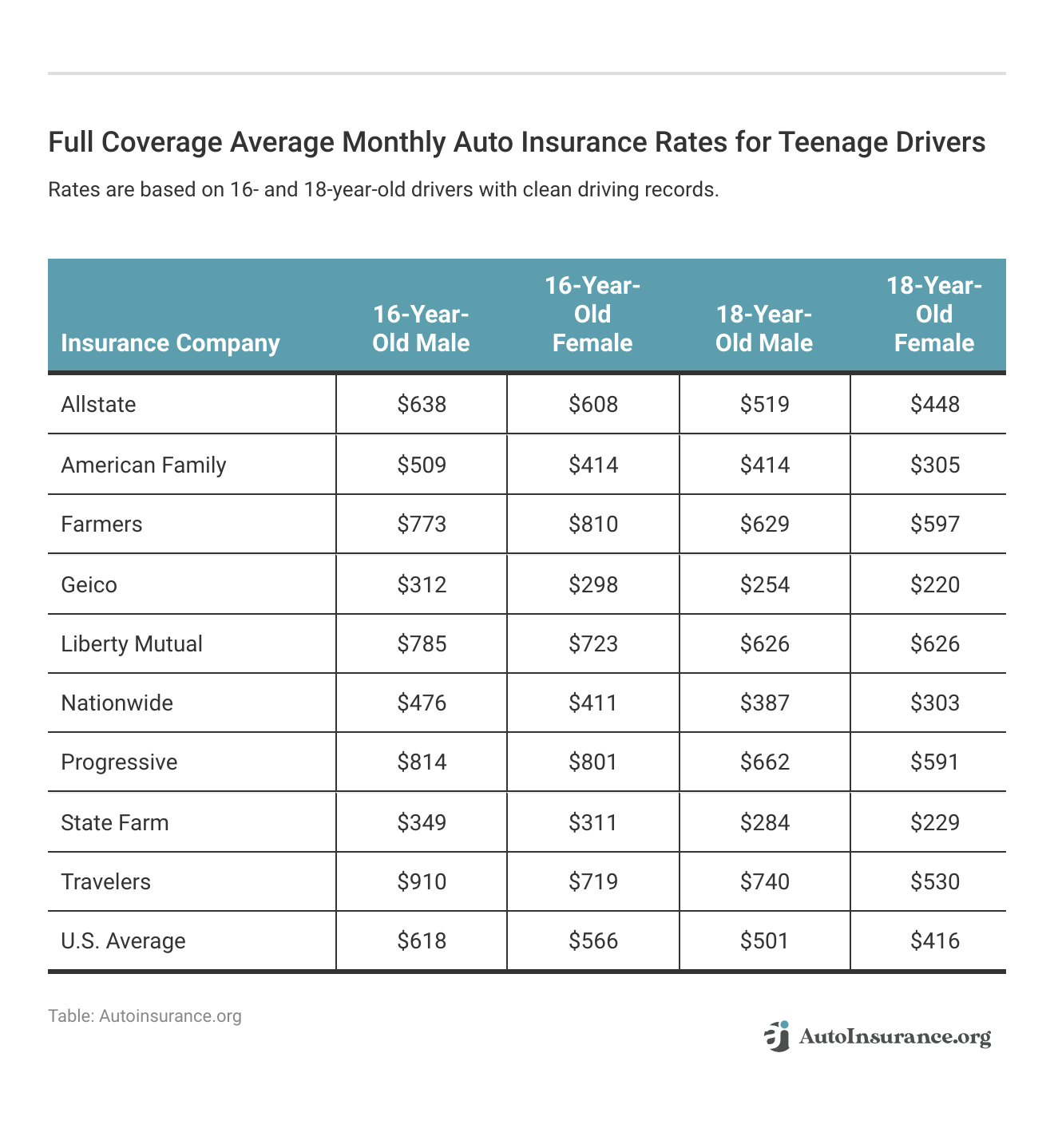

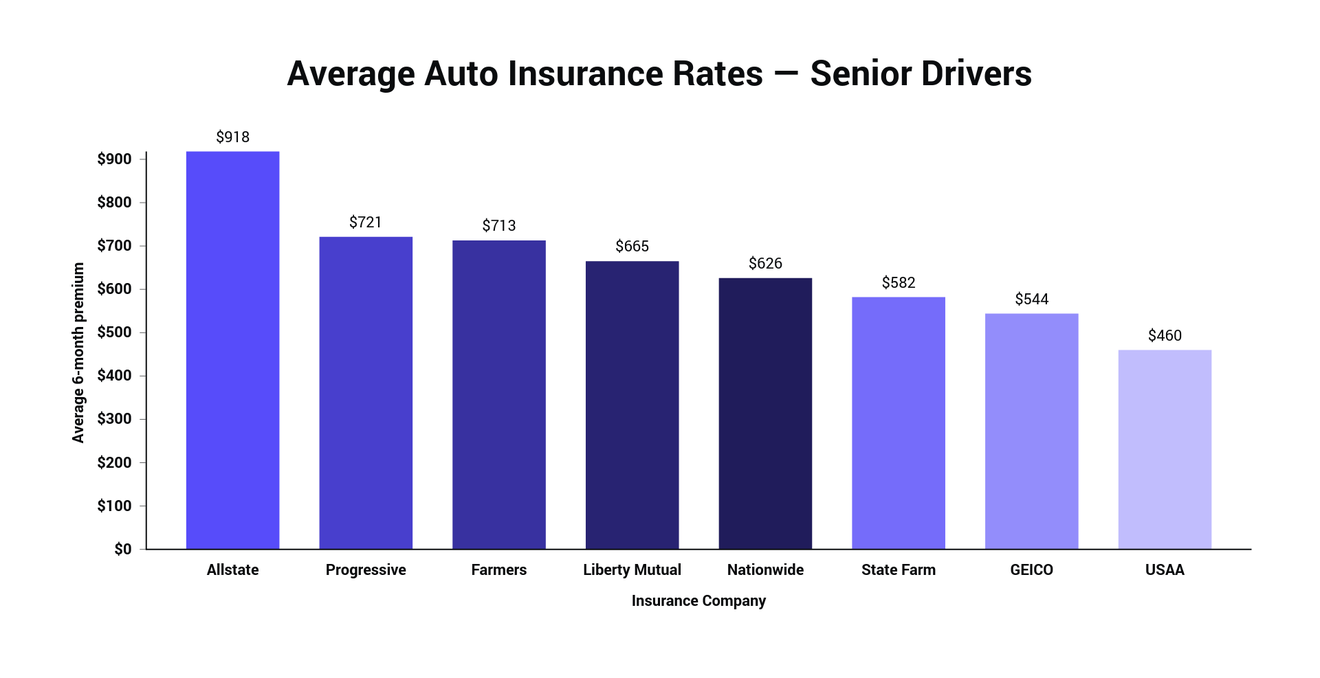

- Age and Gender: Younger, less experienced drivers (especially males) often pay more due to higher accident rates. As you gain experience, your rates typically decrease.

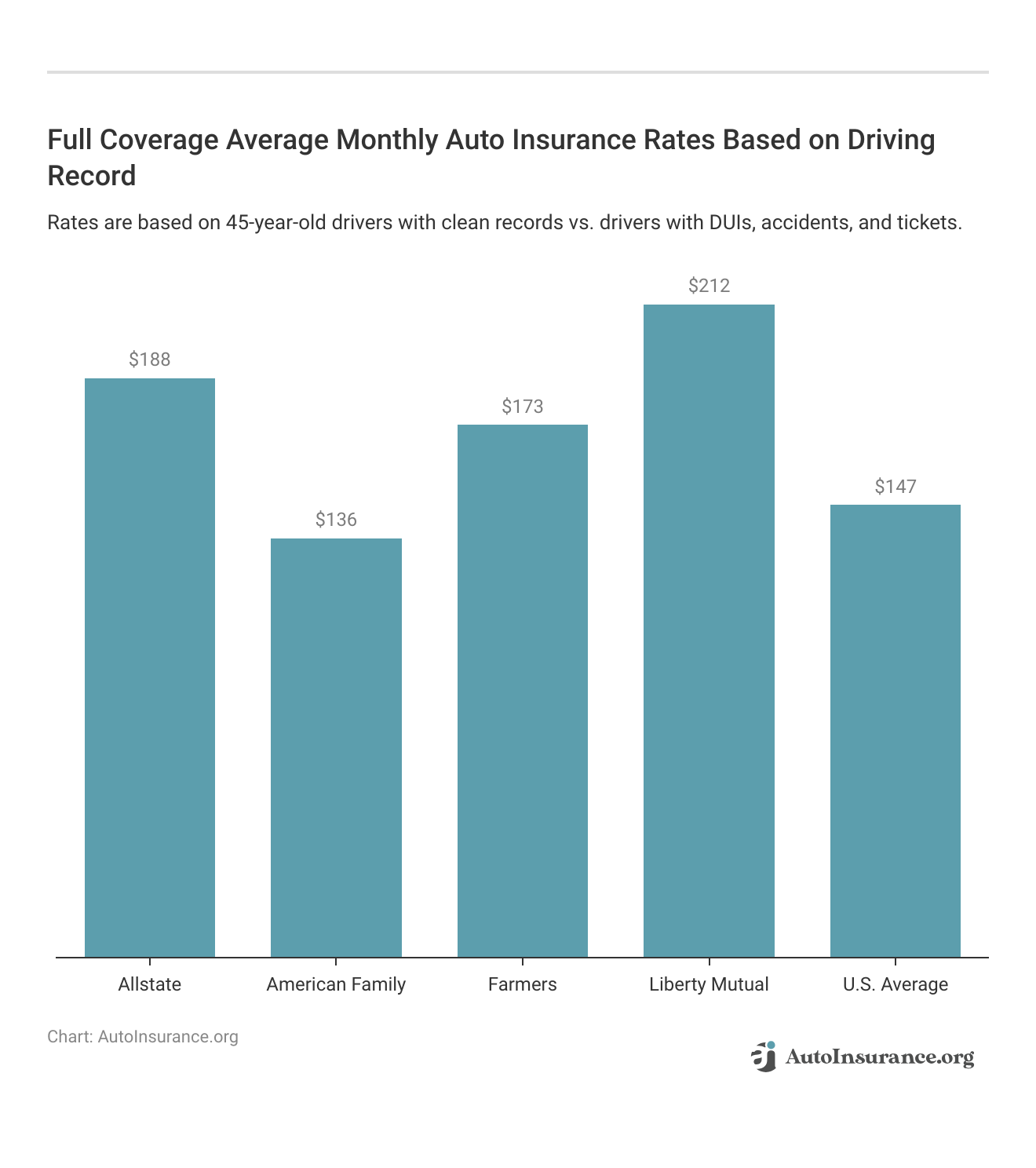

- Driving Record: This is a big one! Accidents, speeding tickets, or DUIs will significantly increase your premium. A clean driving record is your best friend here.

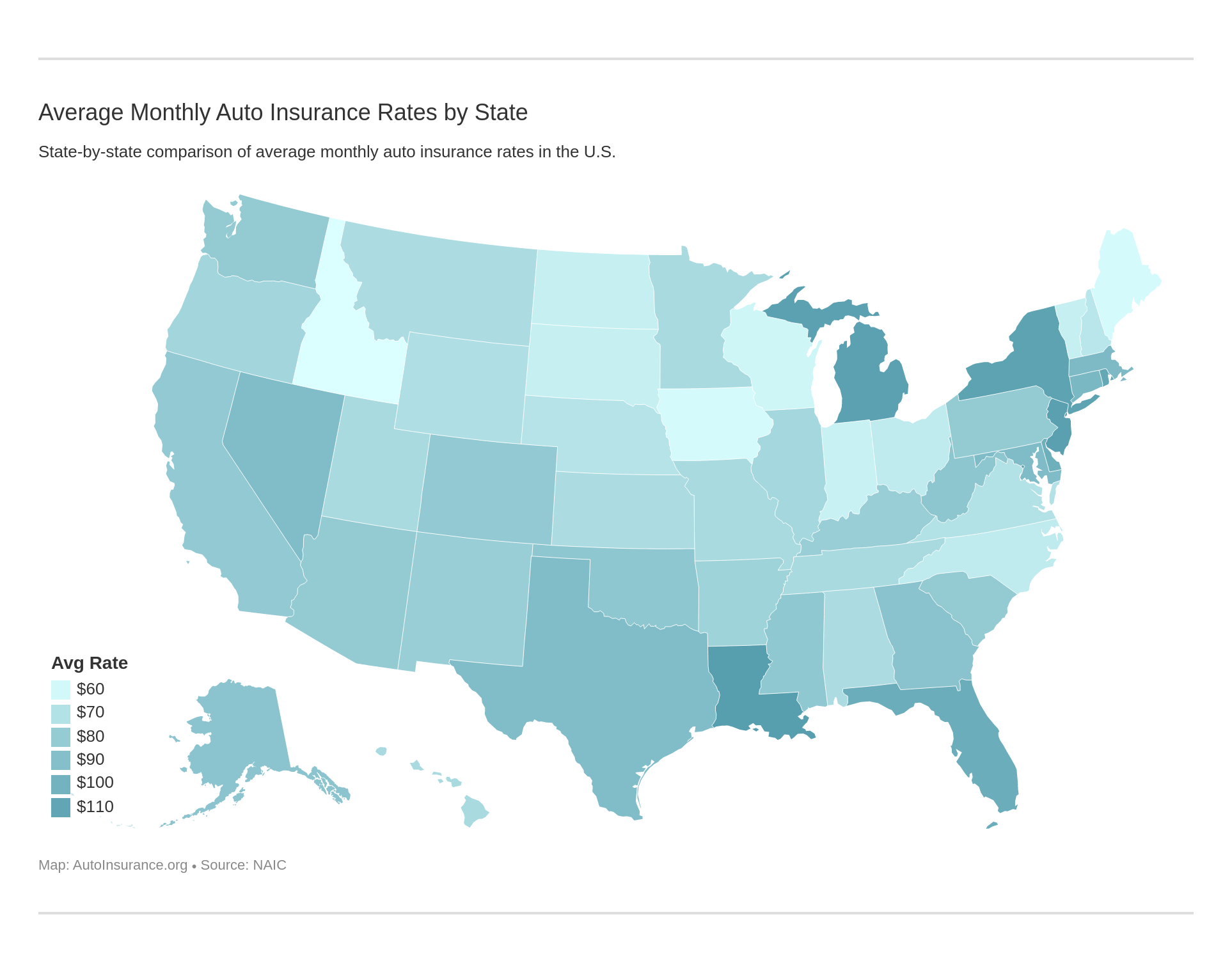

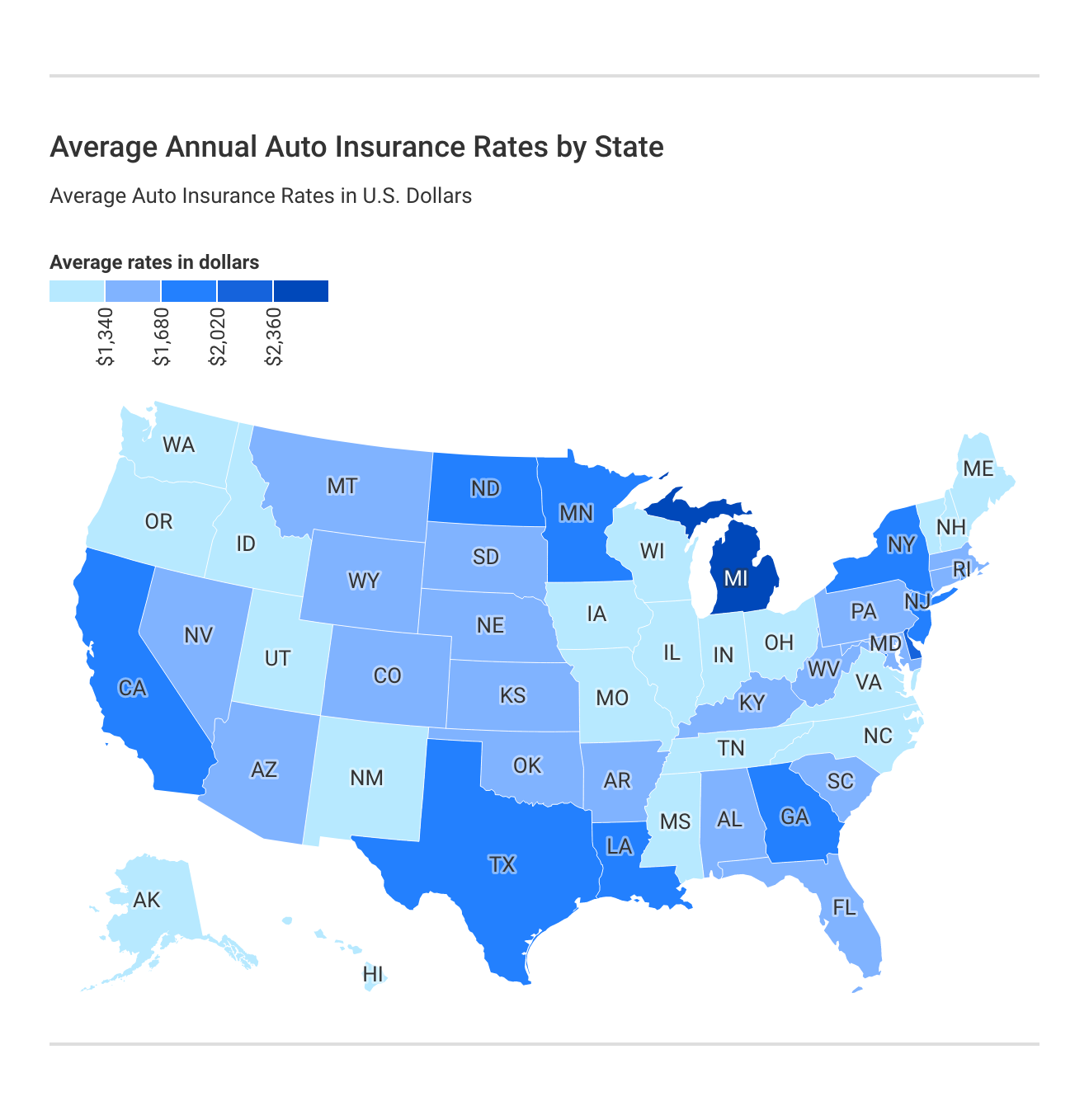

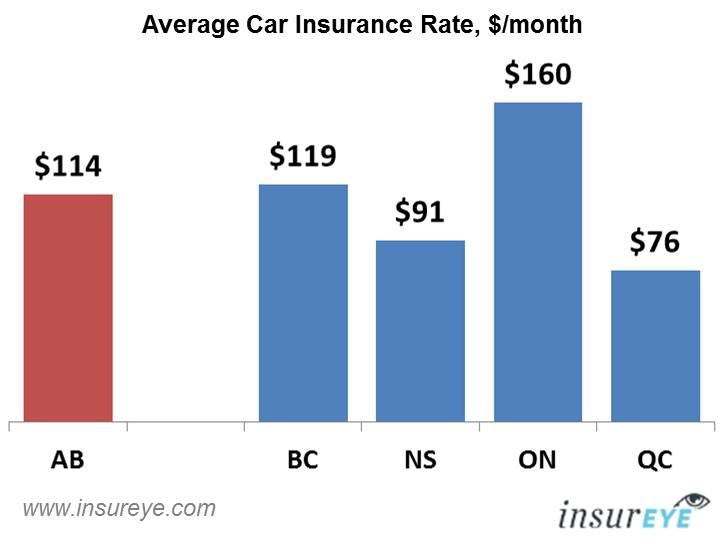

- Location: Living in an urban area with higher traffic density, crime rates, or a greater likelihood of severe weather events can mean a higher average monthly auto insurance cost.

- Credit Score: In many states, insurers use a credit-based insurance score to gauge your financial responsibility, which can impact your rates.

- Marital Status: Married individuals often pay slightly less, as they are statistically considered less risky.

Vehicle-Related Factors

The car you drive is another major piece of the puzzle for your average monthly auto insurance premium. Insurers consider how expensive your vehicle would be to repair or replace, and its general risk profile.

- Make, Model, and Year: Luxury, high-performance, or older models with hard-to-find parts usually cost more to insure.

- Safety Features: Vehicles with advanced safety features (like automatic emergency braking) might qualify for discounts, helping lower your average monthly auto insurance cost.

- Theft Rate: If your car model is frequently stolen, your comprehensive coverage portion will likely be higher.

Policy Choices and Discounts

Finally, your choices regarding coverage and deductibles, along with any applicable discounts, directly influence your average monthly auto insurance payment. This is where you have a lot of control to manage your average monthly auto insurance.

- Coverage Limits: Higher liability limits mean more protection but also a higher premium.

- Deductible Amount: Choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) often results in a lower monthly premium.

- Types of Coverage: Adding optional coverages like comprehensive, collision, or uninsured motorist protection will increase your overall cost.

Maximizing Available Discounts

One of the easiest ways to chip away at your average monthly auto insurance premium is by leveraging discounts. Insurers offer a variety of ways to save, so make sure to inquire about every possible option to lower your average monthly auto insurance.

- Multi-Policy/Bundling: Combine your auto insurance with home, renters, or even life insurance for a significant discount.

- Good Driver/Safe Driver: A clean driving record for a certain number of years (often 3-5) can earn you a discount. Some insurers also offer telematics programs that monitor your driving for potential savings.

- Good Student Discount: If you're a student with good grades, you might qualify for this.

- Anti-Theft Devices: Having an alarm, immobilizer, or vehicle tracking system can sometimes reduce comprehensive coverage costs.

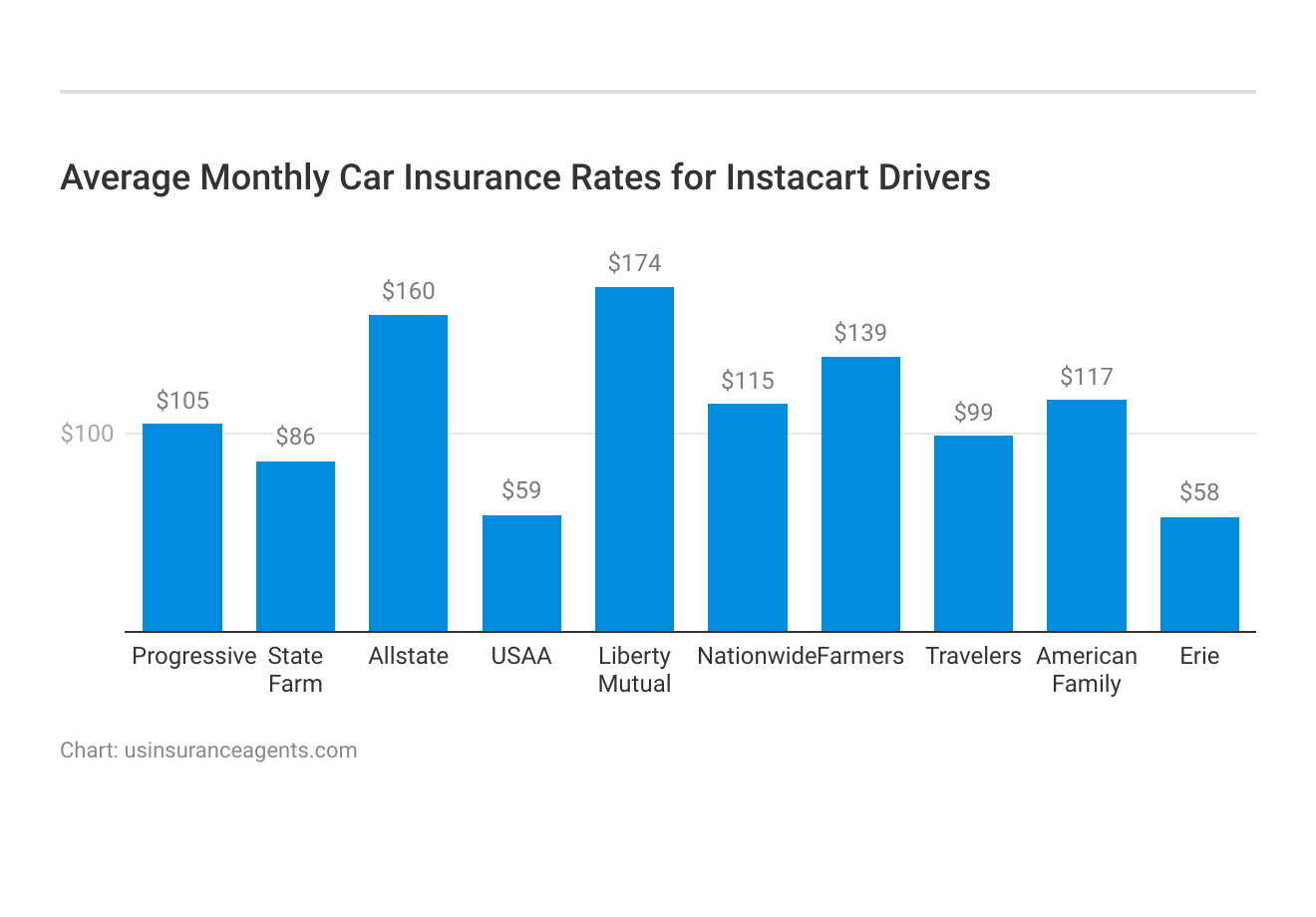

- Low Mileage: Drive less? You might pay less. If you work from home or use public transport often, ask about low mileage discounts.

- Paid in Full: Paying your premium in one lump sum rather than monthly installments can sometimes save you a percentage.

How to Potentially Lower Your Average Monthly Auto Insurance Bill

Now that you know what drives the cost, let's talk about how you can take control and potentially reduce your average monthly auto insurance payments. Small changes can often lead to significant savings over time.

Smart Shopping Strategies

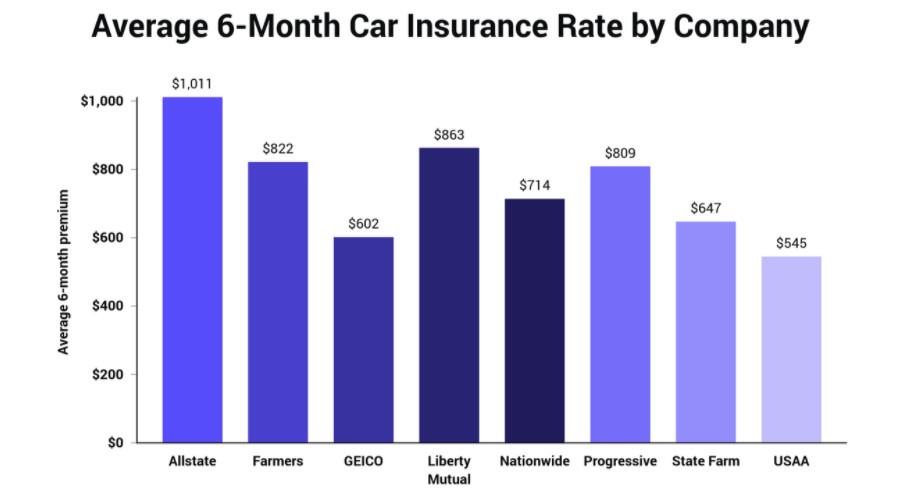

- Compare Quotes Annually: Don't stick with the same insurer out of habit. Get quotes from multiple companies every year or two. Rates change, and you might find a better deal elsewhere. This is crucial for managing your average monthly auto insurance.

- Bundle Policies: Many insurers offer discounts if you bundle your auto insurance with home, renters, or life insurance.

- Ask About All Available Discounts: Seriously, ask! You might be surprised by how many discounts you qualify for, directly impacting your average monthly auto insurance cost.

Driving Habits and Vehicle Improvements

- Maintain a Clean Driving Record: This is arguably the most impactful factor. Avoid accidents and tickets at all costs to keep your average monthly auto insurance low.

- Improve Your Credit Score: A better credit score can lead to lower premiums in many states.

- Consider a Safer, Less Expensive Car: When buying a new car, research its insurance costs. Simpler, safer cars are generally cheaper to insure.

- Install Anti-Theft Devices: Alarms and tracking systems can sometimes earn you a discount, further reducing your average monthly auto insurance.

Conclusion

Understanding your average monthly auto insurance cost means knowing the various personal, vehicle, and policy factors at play. While there's no fixed national average, you now have a clearer picture of what influences your rates. Remember, staying informed and proactively seeking out better deals and discounts is key to managing your average monthly auto insurance expenses effectively. Don't be afraid to shop around and ask questions – it could save you a substantial amount!

FAQ About Average Monthly Auto Insurance

- What is the national average for monthly auto insurance?

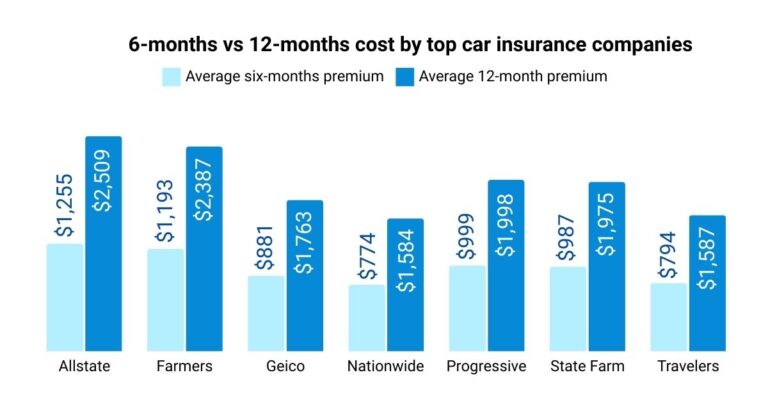

- The national average for monthly auto insurance varies greatly by source and year, but it's often cited as being in the range of $150-$200 per month for full coverage. However, your specific average monthly auto insurance will depend on many factors unique to you.

- How can my driving record affect my premium?

- Your driving record is one of the most significant factors. A clean record with no accidents or violations can lead to lower premiums, while tickets, at-fault accidents, or DUIs will almost certainly increase your average monthly auto insurance cost.

- Is it possible to get cheap auto insurance?

- Yes, it's definitely possible to find affordable auto insurance. Key strategies include comparing quotes from multiple providers, opting for higher deductibles, maintaining a good driving record, and utilizing all available discounts. Focusing on these can help reduce your average monthly auto insurance expenditure.

- Should I compare quotes annually?

- Absolutely! Insurers frequently update their algorithms and pricing. What was the best deal last year might not be this year. Comparing quotes annually or whenever your policy is up for renewal is a smart way to ensure you're always getting a competitive average monthly auto insurance rate.

Average Monthly Auto Insurance

Average Monthly Auto Insurance Wallpapers

Collection of average monthly auto insurance wallpapers for your desktop and mobile devices.

Detailed Average Monthly Auto Insurance Photo in 4K

Experience the crisp clarity of this stunning average monthly auto insurance image, available in high resolution for all your screens.

Lush Average Monthly Auto Insurance View for Desktop

Immerse yourself in the stunning details of this beautiful average monthly auto insurance wallpaper, designed for a captivating visual experience.

Mesmerizing Average Monthly Auto Insurance Abstract Collection

Transform your screen with this vivid average monthly auto insurance artwork, a true masterpiece of digital design.

Exquisite Average Monthly Auto Insurance Abstract for Desktop

A captivating average monthly auto insurance scene that brings tranquility and beauty to any device.

Spectacular Average Monthly Auto Insurance Moment Collection

Immerse yourself in the stunning details of this beautiful average monthly auto insurance wallpaper, designed for a captivating visual experience.

Stunning Average Monthly Auto Insurance Photo for Mobile

This gorgeous average monthly auto insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Average Monthly Auto Insurance Picture Collection

This gorgeous average monthly auto insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Average Monthly Auto Insurance Artwork in HD

Experience the crisp clarity of this stunning average monthly auto insurance image, available in high resolution for all your screens.

Vivid Average Monthly Auto Insurance Design Nature

Transform your screen with this vivid average monthly auto insurance artwork, a true masterpiece of digital design.

Stunning Average Monthly Auto Insurance Landscape Photography

Find inspiration with this unique average monthly auto insurance illustration, crafted to provide a fresh look for your background.

Captivating Average Monthly Auto Insurance Artwork Collection

Find inspiration with this unique average monthly auto insurance illustration, crafted to provide a fresh look for your background.

Beautiful Average Monthly Auto Insurance Capture in HD

Experience the crisp clarity of this stunning average monthly auto insurance image, available in high resolution for all your screens.

Amazing Average Monthly Auto Insurance Moment Photography

Discover an amazing average monthly auto insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Average Monthly Auto Insurance Background Concept

Find inspiration with this unique average monthly auto insurance illustration, crafted to provide a fresh look for your background.

Lush Average Monthly Auto Insurance Moment Illustration

This gorgeous average monthly auto insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Average Monthly Auto Insurance Background in 4K

Discover an amazing average monthly auto insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Average Monthly Auto Insurance Landscape Digital Art

This gorgeous average monthly auto insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Average Monthly Auto Insurance Background Nature

Experience the crisp clarity of this stunning average monthly auto insurance image, available in high resolution for all your screens.

Exquisite Average Monthly Auto Insurance Picture Nature

This gorgeous average monthly auto insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Average Monthly Auto Insurance Wallpaper Collection

Explore this high-quality average monthly auto insurance image, perfect for enhancing your desktop or mobile wallpaper.

Download these average monthly auto insurance wallpapers for free and use them on your desktop or mobile devices.