Automobile Insurance Cost: Unraveling the Mystery!

Ever wondered why your automobile insurance cost seems like a secret formula? You're not alone! For many drivers, understanding car insurance premiums can feel like a complex puzzle. But don't worry, we're here to break it down for you in simple, clear terms.

Your automobile insurance cost isn't just a random number; it's calculated based on a variety of factors designed to assess your risk. By understanding these elements, you can take control and potentially find ways to save money. Let's dive in and demystify those numbers together!

What Actually Influences Your Automobile Insurance Cost?

Many variables come into play when insurance companies determine your automobile insurance cost. They're essentially trying to predict how likely you are to file a claim. Let's look at some of the biggest factors that impact your premium.

- Your Driving Record: This is a big one! Accidents, speeding tickets, or other violations on your record signal higher risk to insurers, often leading to a higher automobile insurance cost. A clean record, on the other hand, can earn you discounts.

- Type of Car You Drive: Is your car a high-performance sports car or a family sedan? The make, model, age, and safety features of your vehicle all affect how much it costs to repair or replace, and thus impact your automobile insurance cost. More expensive cars or those frequently stolen often have higher premiums.

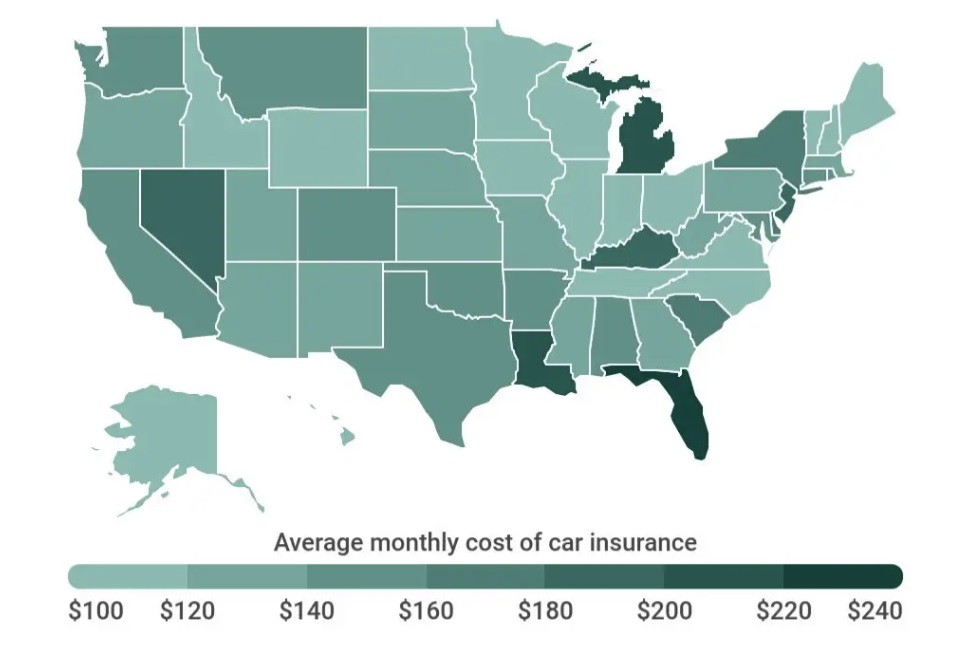

- Where You Live: Urban areas with higher traffic density, theft rates, or vandalism statistics usually have higher insurance rates than rural areas. Your specific ZIP code can significantly influence your automobile insurance cost.

- Your Age and Gender: Statistically, younger, less experienced drivers tend to be involved in more accidents, leading to higher premiums. While gender's impact is decreasing, some states still consider it.

- Your Credit Score (in some states): In many states, insurers use a credit-based insurance score to predict claim likelihood. A better credit score can sometimes lead to a lower automobile insurance cost.

- Coverage Choices and Deductibles: The types of coverage you select and the size of your deductible play a crucial role. More comprehensive coverage and lower deductibles will increase your automobile insurance cost.

Decoding Your Coverage Options and Their Impact

Understanding the different types of coverage available is key to customizing your policy and managing your automobile insurance cost. Each type protects you in different scenarios, and combining them builds your complete protection plan.

- Liability Coverage: This is legally required in most states. It covers damages (bodily injury and property damage) you cause to others in an at-fault accident. It's a foundational part of your automobile insurance cost.

- Collision Coverage: This pays for damage to your own vehicle resulting from a collision with another car or object, regardless of who is at fault. It's often required if you have a car loan.

- Comprehensive Coverage: This protects your car from damage not caused by a collision, such as theft, vandalism, fire, natural disasters, or hitting an animal. It's another important component influencing your total automobile insurance cost.

- Uninsured/Underinsured Motorist (UM/UIM): This coverage protects you if you're hit by a driver who doesn't have insurance or doesn't have enough to cover your damages. It's a smart addition for peace of mind.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): These cover medical expenses for you and your passengers after an accident, regardless of fault. They can be invaluable for immediate care.

Smart Strategies to Lower Your Automobile Insurance Cost

Now that you know what goes into calculating your automobile insurance cost, let's talk about how you can potentially reduce it. There are several proactive steps you can take to make your premiums more affordable without sacrificing essential protection.

- Shop Around & Compare Quotes: Don't settle for the first quote! Different insurers have different pricing models, so always get multiple quotes to find the best automobile insurance cost for your needs. Online comparison tools make this easy.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket if you file a claim, but it can significantly lower your monthly or annual premium. Just make sure you can afford the higher deductible.

- Look for Discounts: Most insurance companies offer a variety of discounts. Ask about good driver, multi-policy (bundling home and auto), good student, defensive driving course, low mileage, or vehicle safety feature discounts.

- Maintain a Good Driving Record: This goes back to a major influencing factor. A clean record with no accidents or tickets over several years will almost always result in a lower automobile insurance cost. Drive safely!

- Improve Your Credit Score: As mentioned, a strong credit score can lead to better rates in many areas. Regularly checking and improving your credit is a good financial habit overall.

- Drive a Safer, Less Expensive Car: When purchasing a new vehicle, consider how its safety ratings, repair costs, and theft rates will affect your automobile insurance cost. Practical choices often lead to savings.

Conclusion

Understanding your automobile insurance cost doesn't have to be a mystery. By recognizing the factors that influence your premiums, from your driving history to your coverage choices, you empower yourself to make informed decisions. Remember, your auto insurance is a vital investment in your financial protection and peace of mind on the road.

Take the time to compare quotes, explore discounts, and periodically review your policy to ensure you're getting the best value. Staying informed is the first step towards managing your automobile insurance cost effectively!

FAQ About Automobile Insurance Cost

- Why is my automobile insurance cost so high?

- Several factors contribute to a high automobile insurance cost, including a poor driving record, driving a high-performance or expensive car, living in a high-risk area, being a young or inexperienced driver, or having extensive coverage with low deductibles.

- Can my credit score really affect my insurance rates?

- Yes, in many states, insurance companies use a credit-based insurance score as one factor in determining your premium. Statistically, individuals with higher credit scores tend to file fewer claims, which can lead to a lower automobile insurance cost.

- Is it always better to choose the cheapest policy?

- Not necessarily. While a lower automobile insurance cost is appealing, ensure the policy provides adequate coverage for your needs. The cheapest option might have high deductibles or minimal coverage, leaving you vulnerable in a major accident. Balance cost with sufficient protection.

- How often should I compare insurance quotes?

- It's a good practice to compare quotes at least once a year, or whenever your policy is up for renewal. Also, consider shopping for new quotes after major life events such as buying a new car, moving, getting married, or if your driving record significantly improves.

Automobile Insurance Cost

Automobile Insurance Cost Wallpapers

Collection of automobile insurance cost wallpapers for your desktop and mobile devices.

Exquisite Automobile Insurance Cost Artwork Illustration

Find inspiration with this unique automobile insurance cost illustration, crafted to provide a fresh look for your background.

Lush Automobile Insurance Cost Picture for Desktop

Find inspiration with this unique automobile insurance cost illustration, crafted to provide a fresh look for your background.

Artistic Automobile Insurance Cost Landscape Digital Art

Find inspiration with this unique automobile insurance cost illustration, crafted to provide a fresh look for your background.

High-Quality Automobile Insurance Cost Moment for Your Screen

Discover an amazing automobile insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Automobile Insurance Cost Picture Illustration

A captivating automobile insurance cost scene that brings tranquility and beauty to any device.

High-Quality Automobile Insurance Cost Design Nature

Experience the crisp clarity of this stunning automobile insurance cost image, available in high resolution for all your screens.

Vibrant Automobile Insurance Cost Wallpaper in HD

Transform your screen with this vivid automobile insurance cost artwork, a true masterpiece of digital design.

Serene Automobile Insurance Cost Capture Concept

Discover an amazing automobile insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Automobile Insurance Cost Background Concept

This gorgeous automobile insurance cost photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Automobile Insurance Cost Photo Photography

Find inspiration with this unique automobile insurance cost illustration, crafted to provide a fresh look for your background.

Lush Automobile Insurance Cost Wallpaper in 4K

A captivating automobile insurance cost scene that brings tranquility and beauty to any device.

Stunning Automobile Insurance Cost Wallpaper Photography

Immerse yourself in the stunning details of this beautiful automobile insurance cost wallpaper, designed for a captivating visual experience.

Vibrant Automobile Insurance Cost Photo for Mobile

Explore this high-quality automobile insurance cost image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Automobile Insurance Cost Wallpaper in HD

This gorgeous automobile insurance cost photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Automobile Insurance Cost Scene Digital Art

Discover an amazing automobile insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Automobile Insurance Cost Moment Collection

Transform your screen with this vivid automobile insurance cost artwork, a true masterpiece of digital design.

Vivid Automobile Insurance Cost Design Nature

Transform your screen with this vivid automobile insurance cost artwork, a true masterpiece of digital design.

Beautiful Automobile Insurance Cost Landscape Nature

Discover an amazing automobile insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Automobile Insurance Cost Background Nature

Experience the crisp clarity of this stunning automobile insurance cost image, available in high resolution for all your screens.

Breathtaking Automobile Insurance Cost View for Mobile

Experience the crisp clarity of this stunning automobile insurance cost image, available in high resolution for all your screens.

Download these automobile insurance cost wallpapers for free and use them on your desktop or mobile devices.