Your Ultimate Guide to Understanding Audi Finance Rates

So, you've decided to buy an Audi. Congratulations! That's a fantastic choice, signaling both style and performance. But before you hit the road in your new Q5 or A4, there's one critical step we need to discuss: securing the best financing. Understanding your potential Audi Finance Rates is arguably the most important part of the purchase process, as it directly impacts your total cost of ownership.

Navigating the world of auto loans can feel overwhelming, full of jargon and confusing numbers. Don't worry; we are here to break down everything you need to know. We'll cover what influences these rates, the options provided by Audi Financial Services (AFS), and crucial tips to ensure you secure the most competitive rate available.

Let's dive straight into the numbers game so you can drive away confidently, knowing you got a great deal on your dream machine.

Understanding How Audi Finance Rates Work

When you finance a vehicle, the finance rate (or interest rate) is essentially the cost of borrowing the money. This rate is expressed as an Annual Percentage Rate (APR), and it determines how much extra you will pay over the principal loan amount throughout the life of the loan. A small difference in APR can translate to thousands of dollars saved or spent over a 60 or 72-month term.

While Audi Financial Services (AFS) sets general guidelines for their financing offers, the rate you personally qualify for is highly individualized. They assess your risk as a borrower, factoring in various aspects of your financial profile and the specifics of the vehicle you are purchasing.

Factors That Determine Your Audi Finance Rates

Lenders look at a combination of personal and loan-specific factors when calculating your potential APR. If you are aiming for the absolute best Audi Finance Rates, paying attention to these areas is key. Here are the primary variables:

- Credit Score (FICO): This is the biggest determinant. Scores above 740 usually qualify for prime rates, often leading to the lowest advertised rates. Lower scores mean higher perceived risk, and therefore, higher interest rates.

- Loan Term Length: Shorter loan terms (e.g., 36 or 48 months) usually come with lower APRs because the lender's money is tied up for less time. Longer terms (72 or 84 months) reduce monthly payments but typically increase the interest rate.

- Down Payment Amount: A larger down payment reduces the principal loan amount, making the loan less risky for the lender. This can sometimes result in better terms and lower rates.

- Debt-to-Income (DTI) Ratio: Lenders assess how much of your monthly income is already committed to debt payments. A low DTI signals a stronger ability to handle the new car payment.

By improving your credit health or increasing your down payment, you actively mitigate the risk for the lender, which translates directly into lower Audi Finance Rates.

New vs. Pre-Owned Audi Finance Rates

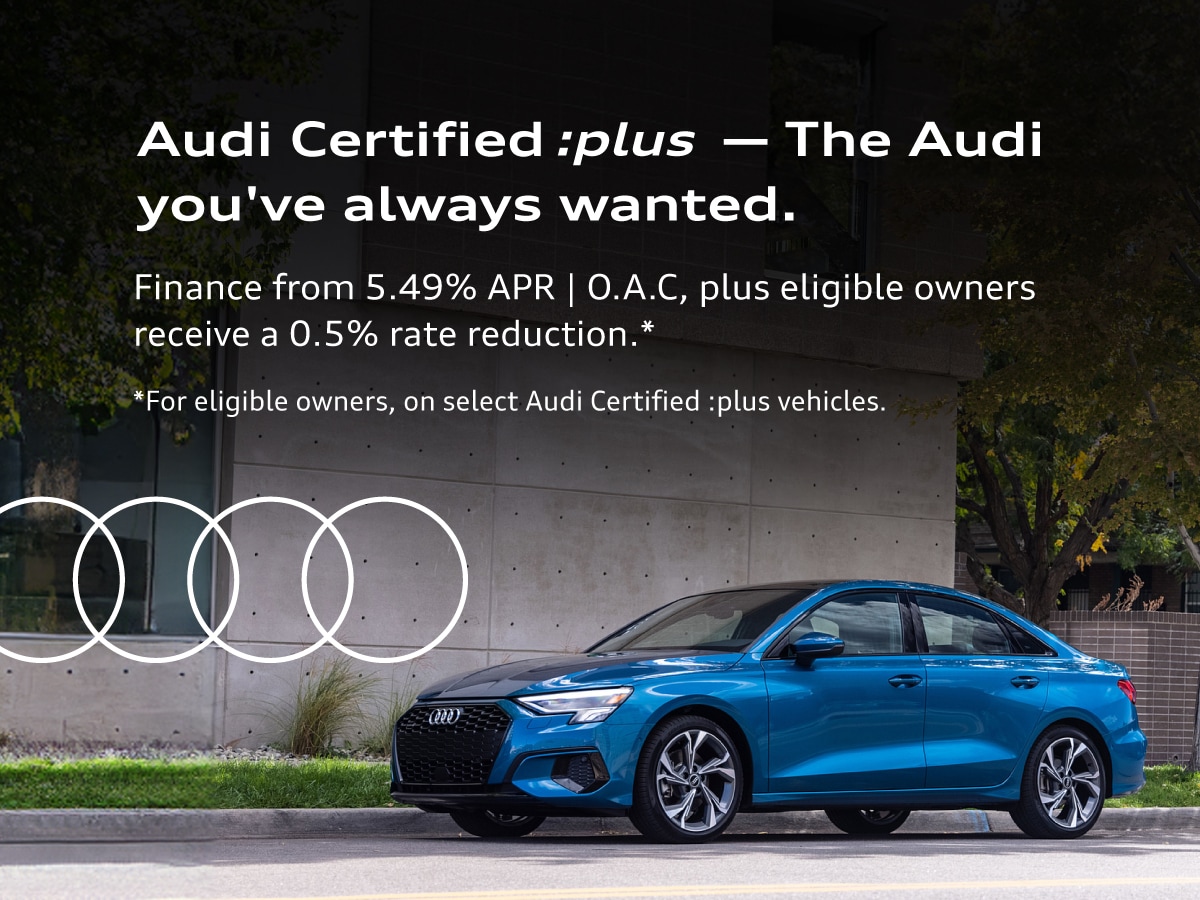

There is often a notable difference between financing a brand-new Audi and a certified pre-owned (CPO) model. New cars frequently qualify for special subsidized promotional rates, sometimes as low as 0% or 0.9%, directly from AFS during sales events. These incredibly low rates are designed to move new inventory quickly.

Conversely, financing a pre-owned vehicle, even if it is Audi Certified Pre-Owned (CPO), usually carries a slightly higher APR. This difference reflects the higher risk associated with older collateral and the fact that promotional incentives rarely apply to used inventory. Always compare CPO Audi Finance Rates against rates from local banks or credit unions, as the rates can be more negotiable in the pre-owned market.

Exploring Different Audi Financial Services (AFS) Options

Audi Financial Services is the captive lender for the brand. Using AFS often streamlines the purchasing process and gives you access to specific incentives that external lenders cannot match. They primarily offer two paths: traditional financing and leasing.

Standard Financing: Purchasing Your Dream Audi

When you opt for standard financing, you are taking out a loan to cover the full cost of the vehicle, minus any down payment or trade-in value. Once the loan is paid off, the car is legally yours, free and clear. AFS offers flexible terms that usually range from 24 to 72 months, allowing you to tailor your monthly payment schedule.

It is important to remember that the standard Audi Finance Rates offered by AFS are competitive, but they might not always be the lowest. Always be prepared to negotiate or compare their offer with third-party lenders.

Special Promotional Audi Finance Rates

Keep an eye out for special seasonal promotions! Audi frequently offers subsidized rates—sometimes called "special financing"—on specific models to boost sales during certain periods. These rates can be significantly lower than the standard market APR. For instance, a program might advertise 1.9% APR for 60 months on all new Audi Q3s.

However, these deals usually require excellent credit (Tier 1 or Tier 1+). If you qualify, these promotional Audi Finance Rates are often unbeatable by outside lenders.

Leasing Programs: Drive a New Audi Every Few Years

Leasing is another popular option through Audi Financial Services, especially for drivers who love the idea of always having the latest technology and safety features. When you lease, you are essentially paying for the vehicle's depreciation during the lease term, plus a finance charge.

In the leasing world, the interest equivalent is called the "Money Factor." While it looks different—a very small decimal number—you can roughly convert it to an APR by multiplying it by 2,400. Even though you aren't building equity, the reduced monthly payments make leasing appealing for many luxury buyers.

Tips for Securing the Best Audi Finance Rates

You don't have to settle for the first offer the dealership gives you. Taking control of the financing process can dramatically lower your costs. Here are our top actionable strategies for landing highly desirable Audi Finance Rates:

- Check Your Credit Score (And Fix Errors): Before stepping foot in a dealership, know exactly where your credit stands. Dispute any errors immediately. Knowing your score helps you gauge if the rate quoted is fair based on your risk profile.

- Get Pre-Approved Elsewhere: Secure a pre-approval from at least one outside lender (a bank or credit union). This gives you a strong negotiating tool. If AFS can't beat your outside rate, you walk away knowing you have a competitive plan B.

- Minimize the Loan Term: If your budget allows, choose the shortest term possible. While the monthly payments will be higher, the overall interest paid will be substantially lower, and your APR may decrease.

- Negotiate the Purchase Price First: Always finalize the actual selling price of the Audi before discussing financing. Mixing the two negotiations often leads to confusion and less savings.

- Take Advantage of Dealer Incentives: Always ask the dealer specifically about current manufacturer incentives or promotional Audi Finance Rates for the model you are interested in.

Remember, the dealership finance manager is there to make a profit. Your goal is to be fully informed and prepared to counter their initial offer with strong evidence of better rates available elsewhere.

Conclusion: Driving Away with Confidence

Purchasing an Audi is a significant investment, and ensuring you get competitive Audi Finance Rates is crucial for protecting your budget. By understanding the factors that influence your APR—primarily your credit score and the loan term—you empower yourself to negotiate effectively.

Whether you choose the convenience of Audi Financial Services for their special promotional rates or opt for a local credit union, always compare offers and secure pre-approval. Taking these proactive steps ensures that the excitement of driving your new Audi isn't overshadowed by high interest costs. Happy driving!

Frequently Asked Questions About Audi Finance Rates (FAQ)

- What is the typical good credit score needed for the best Audi Finance Rates?

- Generally, a credit score of 740 or higher (often referred to as Tier 1 or excellent credit) is required to qualify for the lowest advertised promotional Audi Finance Rates, including 0% or subsidized APR offers.

- Can I get 0% APR financing on a used Audi?

- It is highly uncommon to find 0% APR financing on used or certified pre-owned (CPO) vehicles. These extremely low rates are typically reserved exclusively for new, non-sold inventory to encourage rapid sales.

- Is it better to use Audi Financial Services (AFS) or an outside bank?

- It depends on current promotions. AFS often has the lowest rates when offering subsidized special financing on new cars. If no special rates are running, an outside bank or credit union might offer a better standard APR. Always compare both options before committing.

- Does the loan term length affect my Audi Finance Rates?

- Yes, absolutely. Shorter terms (e.g., 36 or 48 months) usually receive lower interest rates than longer terms (72 or 84 months). Lenders charge more interest risk for extending the repayment period.

Audi Finance Rates

Audi Finance Rates Wallpapers

Collection of audi finance rates wallpapers for your desktop and mobile devices.

Exquisite Audi Finance Rates Scene Illustration

A captivating audi finance rates scene that brings tranquility and beauty to any device.

Vibrant Audi Finance Rates Moment for Desktop

Transform your screen with this vivid audi finance rates artwork, a true masterpiece of digital design.

Detailed Audi Finance Rates View Collection

Experience the crisp clarity of this stunning audi finance rates image, available in high resolution for all your screens.

Mesmerizing Audi Finance Rates Design Nature

Explore this high-quality audi finance rates image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Audi Finance Rates Wallpaper Digital Art

Explore this high-quality audi finance rates image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Audi Finance Rates Wallpaper Collection

Immerse yourself in the stunning details of this beautiful audi finance rates wallpaper, designed for a captivating visual experience.

Artistic Audi Finance Rates Abstract Concept

This gorgeous audi finance rates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Audi Finance Rates Image in HD

A captivating audi finance rates scene that brings tranquility and beauty to any device.

Detailed Audi Finance Rates Capture in HD

Explore this high-quality audi finance rates image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Audi Finance Rates Capture for Mobile

Transform your screen with this vivid audi finance rates artwork, a true masterpiece of digital design.

Beautiful Audi Finance Rates Image for Mobile

Explore this high-quality audi finance rates image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Audi Finance Rates View Photography

Explore this high-quality audi finance rates image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Audi Finance Rates Background Photography

A captivating audi finance rates scene that brings tranquility and beauty to any device.

Dynamic Audi Finance Rates Design in 4K

A captivating audi finance rates scene that brings tranquility and beauty to any device.

Breathtaking Audi Finance Rates Abstract Nature

Transform your screen with this vivid audi finance rates artwork, a true masterpiece of digital design.

Beautiful Audi Finance Rates Moment for Mobile

Transform your screen with this vivid audi finance rates artwork, a true masterpiece of digital design.

Amazing Audi Finance Rates Wallpaper Collection

Explore this high-quality audi finance rates image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Audi Finance Rates Background Collection

Immerse yourself in the stunning details of this beautiful audi finance rates wallpaper, designed for a captivating visual experience.

Gorgeous Audi Finance Rates Photo for Desktop

Immerse yourself in the stunning details of this beautiful audi finance rates wallpaper, designed for a captivating visual experience.

High-Quality Audi Finance Rates Artwork in 4K

Experience the crisp clarity of this stunning audi finance rates image, available in high resolution for all your screens.

Download these audi finance rates wallpapers for free and use them on your desktop or mobile devices.